Guest Post!

How To Budget

Budgeting is the process of creating a plan that outlines how you will spend your expected income. Essentially, budgeting is a system that ensures you take control over your money instead of your money taking control over you. Instead of your money telling you where to go, budgeting helps you guide and direct your money to where you want it to be.

Budgeting is foundational to achieving your financial goals. Maybe you want to retire at 60, pay down 10% of your mortgage or pay 50% of your child’s college tuition costs in cash. Budgeting is how you ensure you are directing your money towards these goals in a way that guarantees you reach them.

What Is Budgeting?

Budgeting is a crucial part of personal finance and it’s difficult to achieve any form of financial wellness without it. In essence, budgeting is the process of creating a smart spending plan.

There are two key components of a budget: your income and your expenses. Income is money earned or received from a variety of sources, including salary, gifts and any investment income. Expenses are the costs incurred when purchasing goods and services.

Budgeting involves outlining your expected income and expenses for a set time — in the world of personal finance, that’s usually a month.

When you outline your income and expenses, three situations can result.

- Expenses can be more than income, creating a budget deficit.

- Income can be more than expenses, creating a budget surplus.

- Expenses can equal income, which results in a balanced budget.

An initial budget surplus is desirable in personal finance since the surplus of income over expenses represents the money you can commit to savings or investments. Therefore, income should be equal to expenses plus savings and investments, rather than just expenses alone.

Budget deficits and initial balanced budgets are undesirable because they leave no room for savings or investments. Rather, with the former, they might even lead to debts. In these cases, the individuals involved must reduce expenses and bring them below income to make room for savings and investments.

Why Is Budgeting Important?

Everyone has financial goals, even if they’re as basic as “I don’t want to incur debts,” or as glamorous as “I want to have a nest egg of $5 million by the time I retire at 65.”

Everyone, rich or poor, has financial goals. Everyone needs to budget so they can ensure that their money is enough to meet those goals.

- Build healthy retirement savings

- Save for college tuition

- Save up a 10-20% down payment to purchase a home

- Start a business

- Pay off student loan debt

- Pay off all debts

- Build an emergency fund

- Improve your credit score

- Create passive income streams

Any goal without a plan is just mere dreaming. A budget is the plan that ensures that individuals achieve their financial goals, whatever they may be.

This goes for making your finances last in retirement. Retirees need to create a retirement budget to ensure that their expenses do not exceed their retirement income.

What Are the Different Budgeting Systems?

Learning how to make a budget can be both simple and complex depending on one’s situation. However, to make the process simpler, many systems have been created. We’ll consider some of these systems below, but this list is not exhaustive of all the options that exist.

The 50/30/20 Rule

U.S. senator Elizabeth Warren popularized the 50/30/20 rule. In this system, 50% of a person’s income is committed to needs (groceries, transport, medical insurance, utility bills, clothing, etc.), 30% to wants (entertainment, eating out, travel, etc.) and 20% to savings or investments. When using this system, income is equal to expenses plus savings and investments.

This budgeting system is simple and has become mainstream in the financial planning world. If you are just learning how to budget, this is a good place to start.

The 60% Solution

Richard Jenkins of MSN Money popularized the 60% solution system. Here, 60% of a person’s income goes to their committed expenses (which include wants and needs). Then 10% each goes to retirement savings, short-term savings, long-term savings and “fun money.”

This system is almost the same as the 50/30/20 rule. The major difference is that it divides savings and investments into three different buckets and raises the allocation for them from 20% to 30% of income. And, instead of separating needs and wants, it lumps them into one and then adds a 10% “fun money” that can be used as the individual pleases.

While it is not quite as simple as the 50/30/20 rule, it is more comprehensive.

Value-Based Budgeting

With value-based budgeting, the values that individuals cherish (rather than expense categories) are the primary budgeting factor. A person using this will have a scale of preference where they use their values to rank various budgeting items. They prioritize the items at the top above the ones below.

With this system, savings and investments are also part of the items to be ranked rather than the last category prioritized, after needs and wants or committed expenses have been met. Someone might prioritize donating to charity before savings and investments, while the reverse might be the case for the next person.

Zero-Based Budgeting

Zero-based budgeting is a strict system where you must account for every last dollar. Here, every item on the budget must be justified from period to period. The fact that an item is crucial or necessary in a month does not give it a pass in the next month. For every new month, the item must justify its inclusion in the budget.

Zero-based budgeting tends to lead to a significant reduction in expenses from period to period. Like value-based budgeting, it does not suggest a figure for certain categories. Instead, every item must be listed and justified on its own strength.

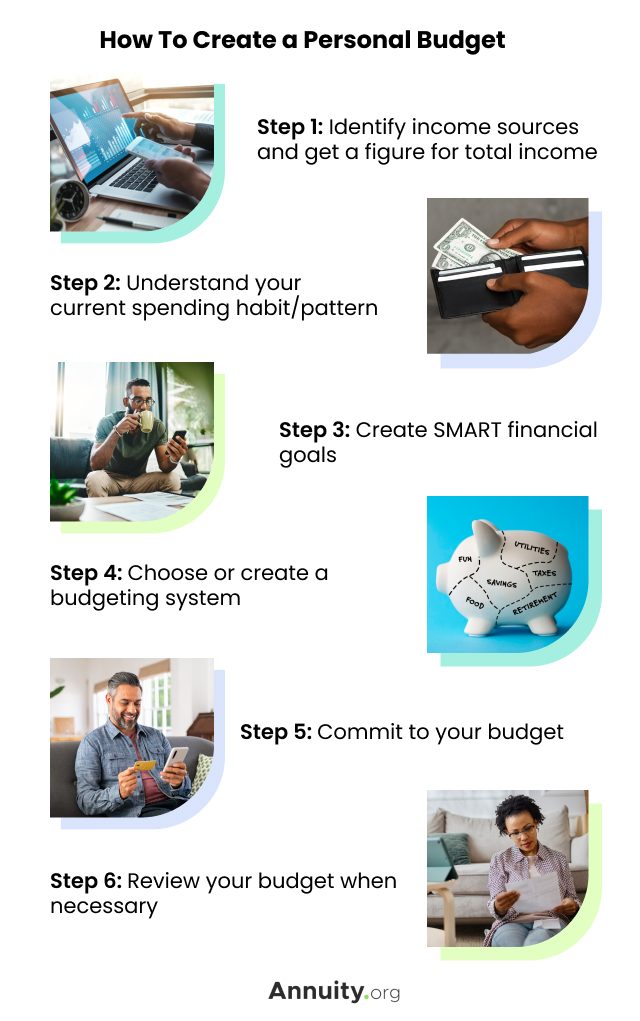

How To Create a Personal Budget for Beginners (Step-by-Step)

The whole purpose of the budgeting process is to ensure that an individual is well poised to achieve their financial goals. Consequently, budgets will vary from individual to individual, just as financial goals vary.

Nevertheless, the following process will be similar for everyone even if the details will be different.

Step 1: Identify Income Sources and Get a Figure for Total Income

Income is the fundamental part of a budget. It’s what everything else depends on.

So, you need to start by identifying all your income sources for the budgeting period (typically a month). These can include wages or salaries or investment income, among other categories.

After identifying them, you need to sum them up to get a total figure that will be the basis of the other steps.

Step 2: Understand Your Current Spending Habits and Patterns

Before committing to a particular budgeting system, it’s always good to first understand your current spending patterns. You can use a pen and paper or a spreadsheet to list out all the items you typically spend money on in the same budgeting period you earn the incomes above.

Step 3: Create SMART Financial Goals

The only reason you should be dissatisfied with your current spending habit or pattern is because you did not design it effectively to achieve your financial goals. So, before choosing or designing a new system, you must be clear about the goals you want to achieve.

Most importantly, your financial goals must be Specific, Measurable, Achievable, Relevant, and Time-bound. Since one person can have many financial goals, you might also need to rank your goals in an order of priority. For example, saving enough for retirement might be more important to Mrs. A than saving for her kid’s college, while a down payment for a mortgage might be more important to Mr. A than building an emergency fund.

Step 4: Choose or Create a Budgeting System

You can then use any of the budgeting systems above to reshape your current spending habit to the one you need to achieve your financial goals. If you are just learning how to budget money, the 50/30/20 rule remains your best bet. Even if you are not just learning how to budget, it is still the most popular because of its simplicity and ease of use.

With this system, you will need to take your list from step 2 and divide it into needs, wants and savings and investments. Then you need to work at ensuring that they meet the 50/30/20 allocation formula. This means you might have to eliminate or reduce some expenses to stay true to the allocation formula.

Follow the same process if you’re using the 60% solution system. You will need to take the list in step 2 and divide it into committed expenses, short-term savings, long-term savings, retirement savings and “fun money.” Then you need to take the next step — ensuring that these categories adhere to the 60/10/10/10/10 allocation formula.

You can also ditch categories entirely and work on an item-by-item strategy with either the values-based system or the zero-based budgeting system. The important point here is to ensure that you are saving enough money every month to accomplish your financial goals. The money you save and invest is the engine of your wealth building and wealth is what you need to achieve your financial goals. So, after doing an item-by-item evaluation, ensure you are saving enough to achieve your goals.

Alternatively, you can edit the 50/30/20 and 60% solution systems to fit your personal circumstances. For example, there are people in the Financial Independence, Retire Early (FIRE) movement who commit up to 70% of their income to savings and investments instead of the 20% recommended by the 50/30/20 system. The point here is not that you need to do the same. Rather, you can use this system and tweak it to fit your personal situation.

Step 5: Commit to Your Budget

Once you have created a budgeting system that reflects your personal financial situation, you need to learn to commit to it.

Two popular ways to do this are through the envelope system and automation. With the former, you will need to withdraw all your income, create envelopes for every spending category and split your income among those envelopes.

While this system can help develop the needed discipline, it can be very impractical unless you are one who spends cash for everything.

The alternative is to automate most of your spending, most especially your savings and investments. This idea goes back to George Clason who encouraged people to pay themselves first (that is, save first) before spending money on anything else. With this, you can automatically remove the portion dedicated to savings/investments and transfer it to your investment accounts.

You can also automate expenses that can be automated, like utility bills. This ensures that the money goes to where it should go, leaving little room for any maneuvering.

Step 6: Review Your Budget When Necessary

While it’s crucial to commit to a well-designed budget, circumstances might require a review. These can range from an increase in income to a change in household composition (marriage, childbirth, divorce, etc.) or a change in goals.

When these changes occur, it’s wise to review your budget and make adjustments as needed.

A final important point must be made. While practicing how to make a budget, it’s best to involve your financial advisor. Your financial advisor should not only be an investment advisor. They should be involved in your financial planning as early as the budgeting stage. In this way, they can help you make crucial decisions that will ensure that your budget is on the right track to achieving your goals.